My dear friends, it’s been too long! It’s much overdue for me to write up a series of observations and research on the state of the markets, Laissez Faire’s place in them, and the forward-looking view as we enter extremely uncertain times in both the crypto world and traditional markets.

Personal Updates:

As you all know, I’ve been more than preoccupied with my company Velvet (which recently raised $4M and was valued at a 20M Valuation). Our investment round was led by Outlander VC (First check invested in Angellist and 16 other unicorn companies), The Winklevoss Brothers, Arieli Capital (A group of billionaire families), 10x Capital, Peak Capital, and some other amazing investors such as dinosaur collectors.

It’s been an incredibly busy last 6 months but I’m excited for what 2023 holds for both Velvet and Laissez Faire. It’s been a wonderful journey with you guys, and I always am grateful for your support in me and this awesome thing we have going!

I still remain the largest stakeholder in Laissez Faire by % owned of the AUM and continue to believe that it will be a stable source of returns in midst of all of the market turmoil, and perhaps still remain one of the highest returning investments when measured by ROI.

Performance: (and bragging rights!)

Key Takeaways:

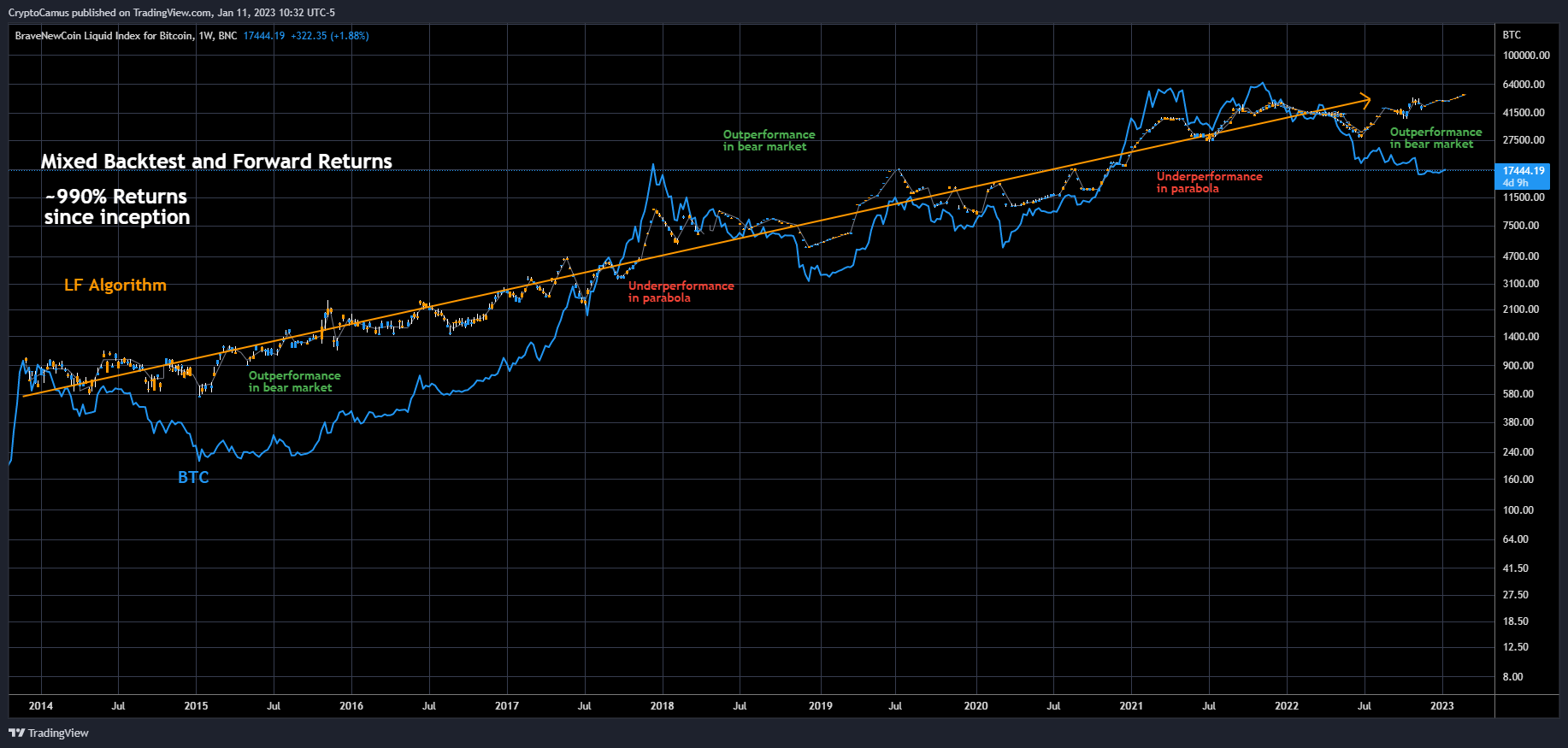

- The fund is on track for a quadruple-digit return

- Bitcoin has drawn-down -76% in the 2022 year from high to low

- In that same period of high to low, LF has produced positive returns of >40%

- LF’s Largest Drawdown since inception: -19%

- 2022 was LF’s worst year thus far, and it still outperformed nearly every other public investment.

- 2023 should be a much better year for performance given likely volatility expansion and a new trend being formed, hopefully to the upside in Q2 onwards.

- The fund has vastly outperformed nearly all major asset classes in 2022, including the stock market, Bitcoin, bonds, commodities, etc.

Laissez Faire has done an amazing job navigating this downturn and is sitting at all-time-high returns as of today 1/11/2023.

Market Update:

2022 has been a terrible year for the crypto space, with a massive loss of trust predicated by the failures and bad actors in 3AC, Celsius, and especially FTX. As a player in this space since 2014, I’d argue this was the largest damage to trust and reputation that crypto has ever experienced. Bitcoin naturally, has suffered immensely and so has almost every alt-coin in the space including the majors like Ethereum, Cardano, and Polygon.

Long-Term Outlook:

While trust and adoption were deeply stunted by the failures of bad actors, Bitcoin is fundamentally bound by many hard money effects, network effects, and commodity pricing. I still firmly believe that Bitcoin is here to stay, and it will find its place in the world as a global store of value and sovereign medium of exchange. It’s still such a new idea, and the value of it is still being determined by market participants.

Bitcoin as a commodity:

Bitcoin is very similar to a commodity, and commodities – while volatile, generally gravitate to their costs of production. Bitcoin’s commodity-cost floor is equivalent to the cost of electricity to produce it, thus Bitcoin is heavily correlated to the value of energy. While supply and demand fluctuate, over a long period of time supply remains in perfect equilibrium due to the production of miners. As long as demand remains constant, Bitcoin is more or less programmed to increase in value over time; because it operates on a fixed deflationary schedule due to the halvings.

The supply of Bitcoin is limited to 21 million coins. As more bitcoins are mined, the difficulty of the mathematical calculations required to mine new bitcoins increases. This is known as the “mining difficulty.” As the mining difficulty increases, it becomes more expensive for miners to create new bitcoins, which can lead to a decrease in the number of miners participating in the network.

The demand for Bitcoin, on the other hand, is determined by a variety of factors, including investor sentiment, adoption by businesses and individuals, and perceived utility of Bitcoin as a medium of exchange or store of value.

- Scarcity: Like other commodities, such as gold or oil, there is a finite supply of bitcoin. The maximum supply of bitcoin is set at 21 million, and as of January 15th, 2023, 18.7 million of those have been mined. This scarcity can drive up demand and increase the value of bitcoin.

- Store of value: Bitcoin can be used as a store of value similar to gold. It is decentralized and can be easily transferred across borders, making it an attractive option for those looking to protect their wealth from inflation or political instability.

- Utility: Bitcoin can be used as a medium of exchange, similar to how commodities such as gold have been used in the past. It can be used to purchase goods and services and can be traded on various cryptocurrency exchanges.

- Market size: The crypto market overall has grown significantly over the past few years and continues to grow. Bitcoin is the largest crypto by market capitalization and it has a sizable and active market.

- Volatility: The price of bitcoin fluctuates significantly, reflecting the trends of supply and demand on the market, which is similar to the price volatility of traditional commodities.

The Halving:

Bitcoin halving is a built-in feature of the Bitcoin protocol that occurs approximately every four years. It is designed to control the rate at which new bitcoins are created.

During the halving, the amount of new bitcoins created with each block mined on the network is cut in half. This means that the reward for mining a block of transactions is halved. Before May 2020, the reward for mining a block was 12.5 bitcoins, and after the halving it dropped to 6.25 bitcoins. And the next halving will be taking place in 2024 and the reward will be dropped to 3.125 bitcoins.

The reason for the halving is to control the rate at which new bitcoins are created and to keep the rate of inflation under control. Since the total supply of bitcoins is limited to 21 million, the halving is designed to ensure that all bitcoins will be mined by the year 2140.

Historically, the halving has had a significant impact on the price of Bitcoin. The halving can lead to a decrease in the supply of new bitcoins and an increase in the value of existing bitcoins, as it increases the scarcity of bitcoins in the market. This can lead to a sharp increase in the price of Bitcoin as demand exceeds supply.

My Outlook:

I expect Bitcoin to take a good amount of time grinding out the lows and ranging as the sentiment of the market recovers. Institutional investors are still deeply interested in the space and finding ways to gain exposure, however that was definitely slowed down by the huge failures of 2022 like FTX. While I’d say we are likely through the majority of the bear market at this point, I still would remain open-minded to Bitcoin making lower lows or spending a lot of time consolidating between 15-30k. During this time I’m expecting LF to take advantage of the volatility and continue to perform with outsized returns (Let’s pray for a triple-digit 2023!).

I’d like to refresh some of my fundemental views on Bitcoin as an asset and it’s place in the world:

Quarterly Opening Months for 2023:

January

April

July

October

4 Year Anniversary:

Wow, it’s been a real ride! In March, LF will have been around for 4 years. During these 4 years so much has happened, and it frightens me that so much time has gone by so quickly. I anticipate we’ll have to throw a party to celebrate! I’ll keep you all updated as this comes together.

3 comments

Mark Sorensen

Thank you Alex! Much gratitude for you and your efforts! The best is yet to come!

Tap Group

Thank you Alex! Much appreciated and thorough update. As we invested a few months before bottom market, it’s been fantastic only seeing gains or flat returns as everyone else loses their shorts. Thank you!

Brady

Alex thank you! So grateful to be part of this journey with you. You bring a balanced and insightful perspective that I just haven’t seen out there. You are in the early innings, can’t wait to see where you take things in the years to come.