Markets now stand at an important and pivotal area that will likely determine the tone for 2021. The last year has created multitudes of “Never before seen in history” moments that have created confusion, volatility, and massive opportunities in markets. I’d like to turn the focus to traditional markets, as they have a large impact on the outcome of Bitcoin despite what many Bitcoiners like to believe. I illustrate this in this article that goes into the correlations of Bitcoin to other assets. I’ll also go into the two scenario’s that Bitcoin faces in the near term, and how we’ll soon see which plays out.

Echoes of February 2020

The current slow-grind-up structure of the Dow Jones and SPX has been ominously similar to the meetup leading into the February and March coronavirus crash. This pattern of slowly moving upwards with highs being sold into is often at the tail end of market moves, and as the range gets tighter and higher; it becomes more prone and sensitive to a large move downwards to find value.

The Dow has a very similar signature…

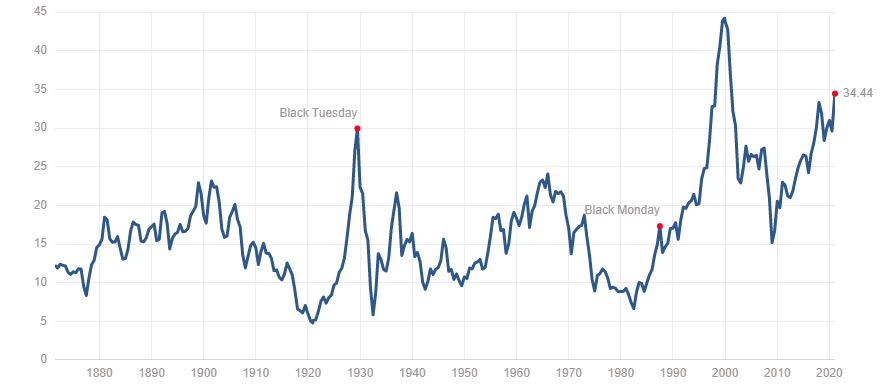

There is no doubt that the markets have become extremely frothy, with stock valuations exceeding many metrics only seen during the roaring 20’s leading into the great depression, and 1999’s tech bubble, leading into the crash of tech stock valuations in 2000. While there isn’t sense in calling an end to the madness, as markets can trend much longer than expected – there are always cracks in the surface that can be seen before the floor gives out.

Tech earnings are being reported all week, with the big names being AAPL, TSLA, MSFT, and AMZN. These tech companies are under immense pressure to not only outperform earnings expectations but also do so in the midst of the largest unemployment crisis and recession since the great depression.

Markets stand at a pivot, where tech performance, the bond market, inflation expectations, the Fed’s actions, and the dollar appear to be ready to shift the paradigm to another melt-up phase, or a large correction, and even a crash. This behavior will echo throughout world markets, and Bitcoin – so it’s time to pay attention.

Frothy Valuations

Schiller PE Ratio, Historic

Rampant Speculation

Margin Debt (Amount of borrowed money outstanding by investors) soared 62% in the past 9 months.

In the past, such euphoria happened only 4 times:

– Aug 1973: stocks rallied a little more, followed by a -50% bear market

– July 1983: -14% correction began

– March 2000: bear market began

– June 2007: bear market shortly after, rally first

– Now

Many examples exist, but one of note is certainly Game Stop, a company that declared that it was filing bankruptcy but was saved by speculative investors piling into the stock and its options, generating a ‘short squeeze’ of massive proportions, forcing a market of no-sellers. Game Stop’s volume on Tuesday was higher than that of the entire dow jones index, and all of the FANG stock’s volume combined. Truly unprecedented and exemplary of the incredible market we’re in.

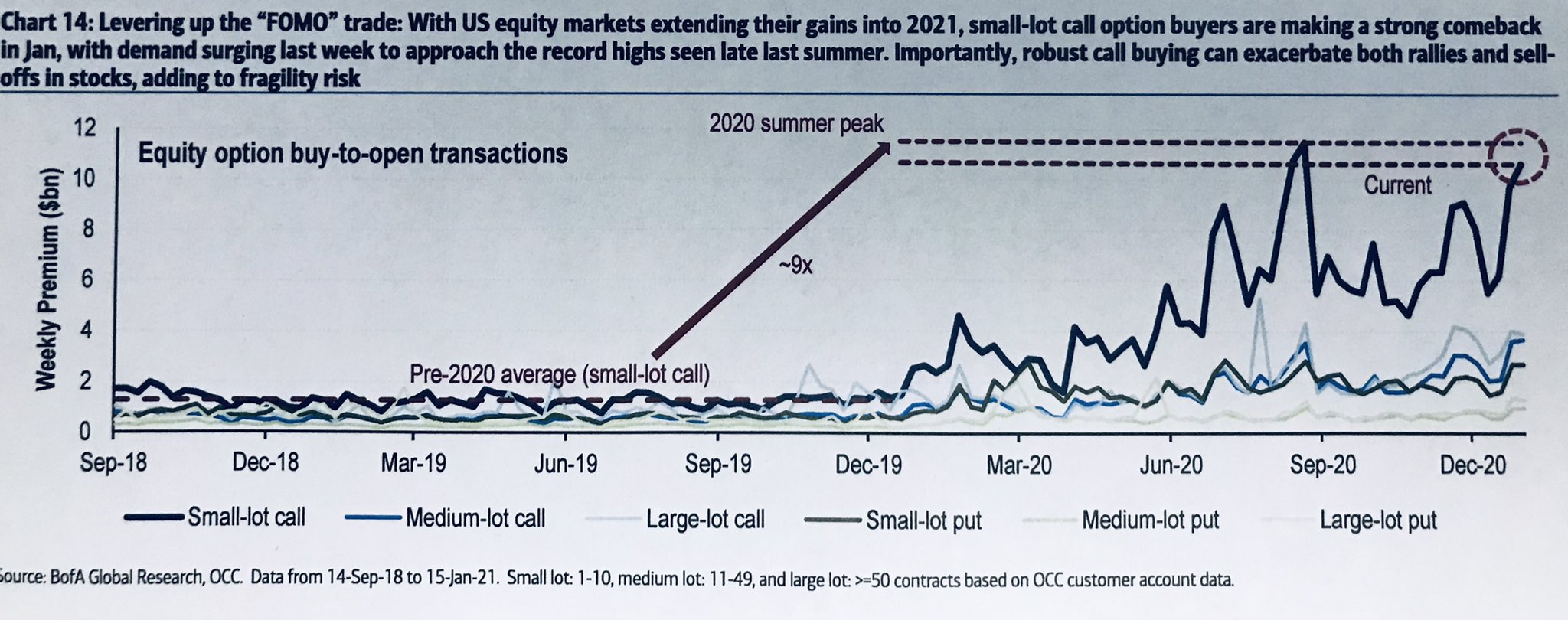

Long, buy-to-open equity options is the current instrument of choice for betting big on the stock market going up, and it has consistently been at historical levels since September 2020. This means more investors than ever are speculating with leverage on the stock market.

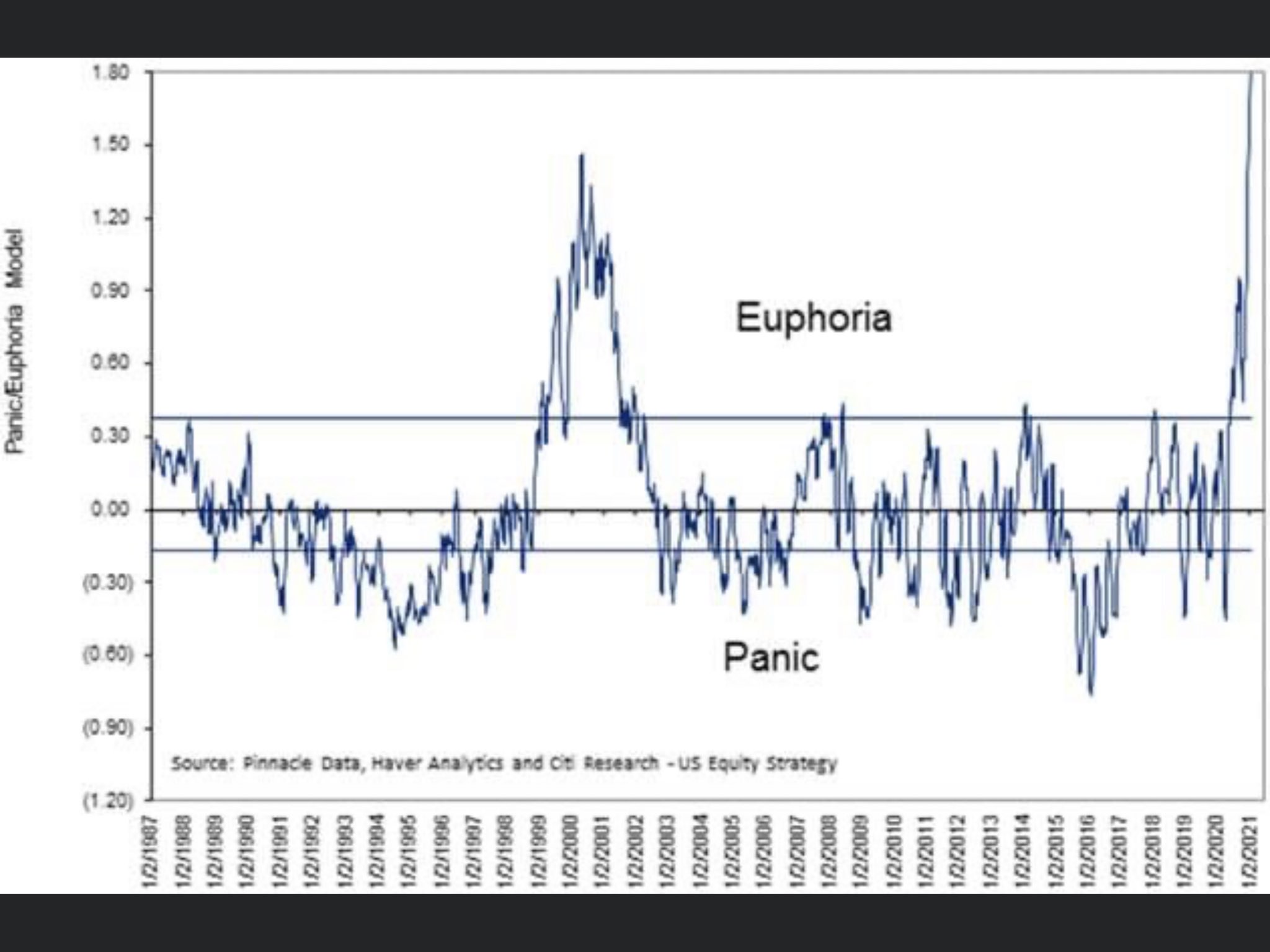

Citibank has long had an index to measure investor sentiment by levels of euphoria and panic. They had to make a new scale this year, as it exceeded the euphoria levels seen in 1999.

Anecdotally, I don’t think I’ve had a week where so many people have asked me about the stock market in such a short period of time. Interesting times indeed.

A basing US Dollar

All assets trade against the US dollar, which has been particularly resilient in this area as inflation struggles to take hold in the US economy, despite the massive stimulus and the actions by the FED.

Technical Red-Flags

An indicator that the LF Algo uses to evaluate trend exhaustion has been signaling for a large correction to take place. This Tom Demark Sequential indicator has predicted many highs and many lows, in both traditional markets and Bitcoin in the past.

The SPX seems to not enjoy being above this trend line for very long since the volatility unwinding in 2018…

Bond Market Hinting at Rising Rates

Rising rates are bad for stock valuations, reduce the money supply, and make debt more expensive in the economy as a whole. A large part of the 2020 rally has had to do with historically low-interest rates globally. Ultimately the bond market can force rates higher though, which creates an issue for the FED and the stock market as a whole.

Insider Selling Elevated Since November 2020

Insiders are the first to know if their companies are underperforming… perhaps a look into this weeks tech earnings?

Two Scenarios for the Future of Bitcoin

The Grim Case

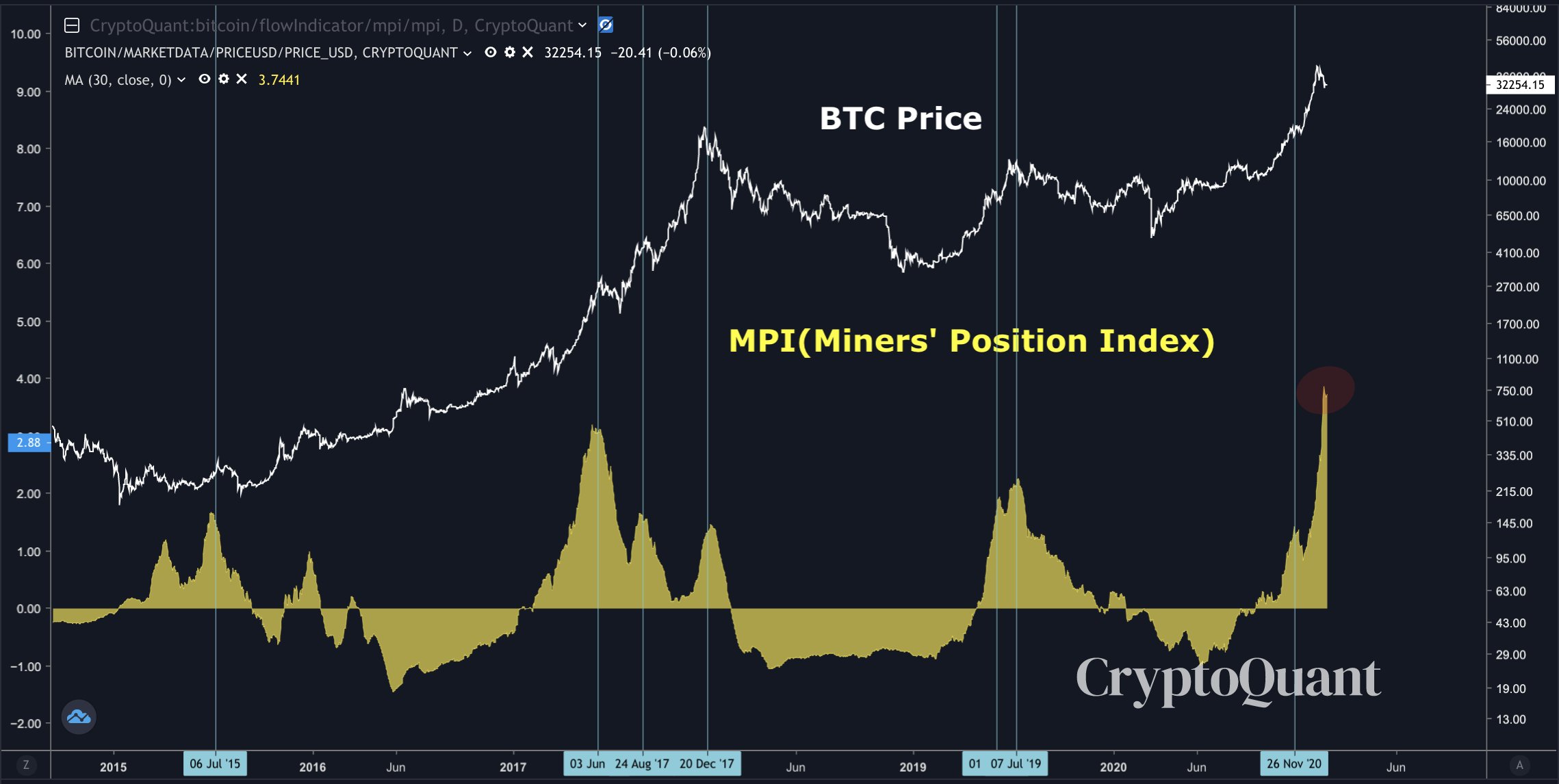

I’ll begin with the more negative scenario first, this scenario implies that a market cycle top has been found around 40k for BTC. While this is possible, I hope it’s not the case. In large trending bull markets of the past, BTC has had many 30-40% corrections throughout its bull market cycles. This correction is what you would call “normal”, however dipping below 24-22k would be indicative that this is more than just a bull market correction for BTC, and perhaps the start of a larger pullback. The main evidence for this scenario is from the recent activity from the Bitcoin miners, and the wall of worry mounting in the stock market. If BTC was unable to hold the 22-24k region, I will expect a much deeper correction over a longer period of time. Until then, it’s safe to assume will continue our upwards trend barring a black swan event.

The Bullish Case

As you know, for a long time I’ve called and written on the possibility of a 100k or greater BTC, evidenced by its supply economics and scarcity. I still believe this is possible, but this scenario can be interrupted by macroeconomic changes, such as a stock market crash – or a black swan event in the crypto space. If we can successfully find a base, and buyers to support the price of Bitcoin in the 22-30k region the trend can continue higher to new ATH’s and likely $100,000 +. It’s truly a pivotal moment for both the stock market and Bitcoin.

In the near-term, BTC is mostly consolidating which has the potential to be long-term bullish if we can find buyers in the 30k region. However, it has been showing weakness as miners heavily sell into this region and investors begin to get nervous. Losing the 29-30k will lower eyes down to the next areas of interest at 28k, and the very important 22-24k region. I expect BTC to attempt to find a base there if it cannot at 30k, and if that area fails there are bigger problems at hand.

On-Chain Analytics and Miner Activity

The miner’s position index is the strongest signal that we are in the middle of a miner-induced correction (they are the main sellers, always). This correction can become just a correction, like June and August 2017, or it can develop into a cyclical top, similar to the 2017 high, and the July 2019 high.

JP Morgan Reading my Analysis?

JP Morgan recently published an analysis of Tether on January 25th, which is remarkably similar to my analysis of the risks behind tether I published 2 weeks ago.

They say all art is stolen, and the best artists steal!

In conclusion, I’ve never seen so many existential risks to traditional markets occurring at once, so now is the time to take heed. Bitcoin unfortunately isn’t immune to its environment and will be affected by what the stock market does. Hopefully, we can continue to trend onto new all-time highs, but if not; I’m confident the algo will mitigate risk and profit as long as volatility remains.

Be cautious, analytical, and Bitcoin on!

3 comments

Neil Galvez

Great read! Thanks for the valuable info, Alex!

Jason Johnson

Thanks Alex, very insightful as always!

Dolores M. Johnson Johnson

I hope the miners remain strong during the market fluctuations.